refund for unemployment tax break

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an. President Joe Biden signed the pandemic relief law in.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Another way is to check your tax transcript if you have an online account with the IRS.

. Unemployment tax refund status. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. The IRS has sent 87 million unemployment compensation refunds so far.

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment. The refunds will be going to the taxpayers who filed their federal tax returns without claiming the break on any unemployment benefits they received in 2020. The amount of the refund will vary per person depending on overall.

22 2022 Published 742 am. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. This threshold applies to all filing statuses and it doesnt double to.

After this you should select the 2020 Account Transcript and scan the. From then on weve received countless requests for an article to cover all the necessities regarding refunds. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. When To Expect A Refund For Your 10200 Unemployment Tax Break. Specifically the rule allows you to exclude the first 10200.

Check the status of your refund through an online tax account. Heres what you need to know. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of.

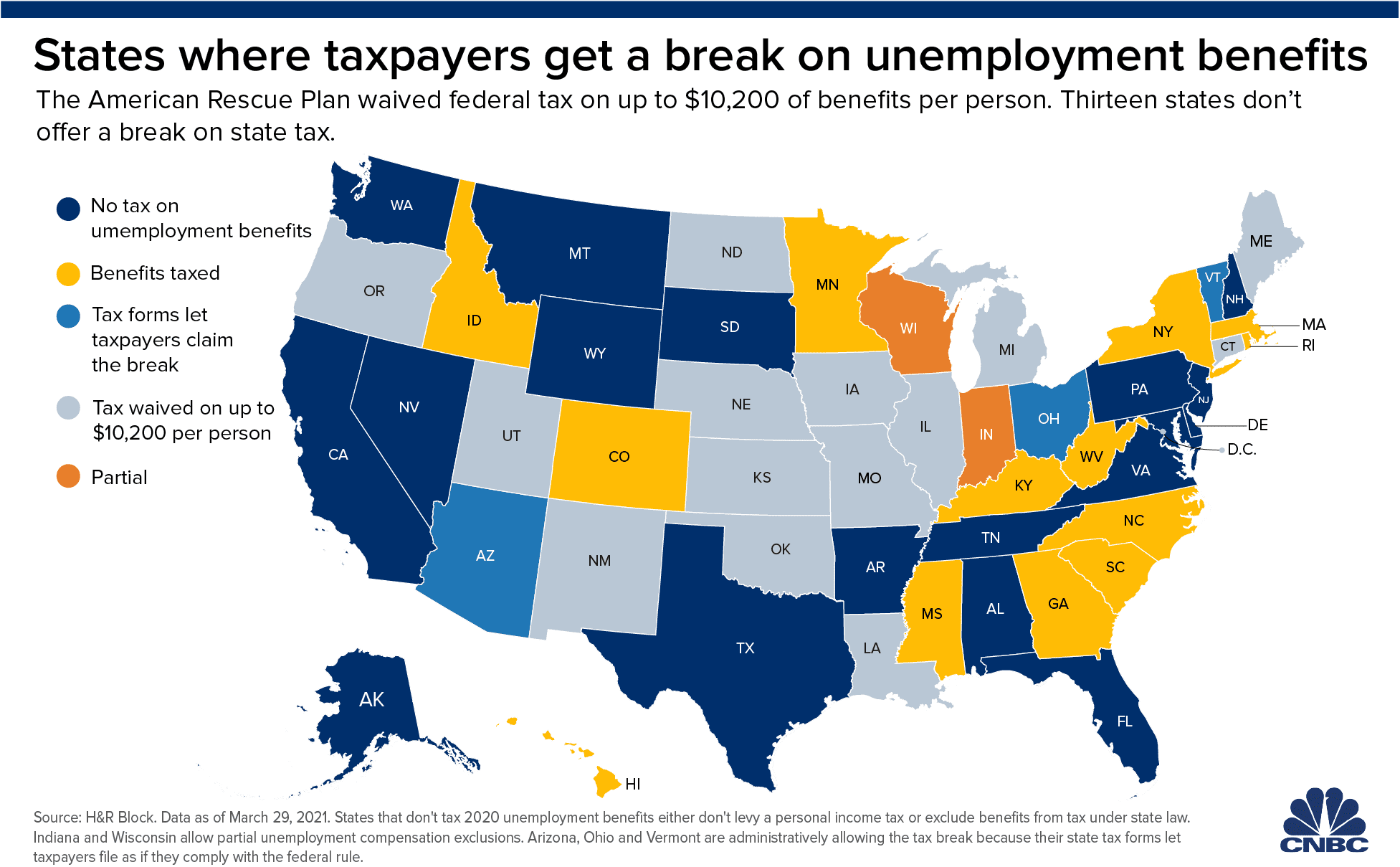

The 10200 unemployment tax break was announced a couple of months back. On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

Thankfully the IRS has a plan for addressing returns that didnt. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. Normally all unemployment income is taxable at the federal level but the new relief bill exempts jobless workers first 10200 in benefits for those earning less than.

However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. The IRS will continue the process in 2022 focusing on more complex tax returns.

Since May the IRS has issued over 87 million unemployment. The agency issued tax refunds worth 145 billion to over 118 million households as of Dec. Blake Burman on unemployment fraud.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. For eligible taxpayers this could result in a refund a. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

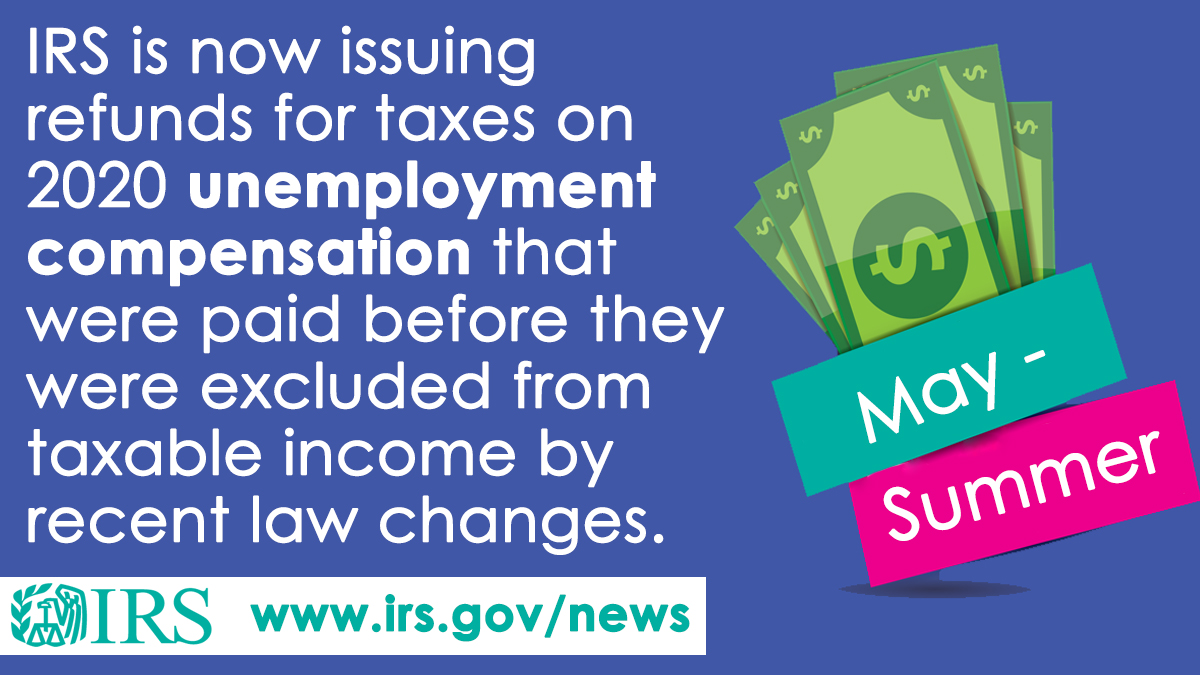

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. This is the fourth round of refunds related to the unemployment compensation exclusion provision. IRS tax refunds to start in May for 10200 unemployment tax break.

The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American. The 10200 is the amount of income exclusion for single filers not the. The Internal Revenue Service has sent 430000 refunds.

By Anuradha Garg. September 13 2021.

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

When Will Unemployment Tax Refunds Be Issued King5 Com

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

When Will Irs Send Unemployment Tax Refunds 11alive Com

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Interesting Update On The Unemployment Refund R Irs

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break